Who is really running PHNs, why state revenues offices don’t want to fight about payroll tax, and how was the new RACGP boss selected?

As reported by HSD earlier this week, a damning report from the Australian National Audit Office (ANAO) suggested that the DoHAC was not able to prove that PHNs were achieving their objectives because they were not being measured properly.

At more than $1.3 billion a year in funding that’s quite a bit of public money going into the heartland of general practice while, according to the ANAO, we have very little idea about our return on investment.

DOHAC’s high-level take on PHNs is as follows:

“Primary Health Networks (PHNs) are independent organisations that we fund to coordinate primary health care in their region. PHNs assess the needs of their community and commission health services so that people in their region can get coordinated health care where and when they need it”.

The ANAO report isn’t going to bolster the PHN image in the eyes of a lot of GPs, a significant proportion of whom don’t see them helping at all in their region.

In a 2018 AMA survey of PHNs 58% of GPs felt they weren’t improving access to care in their region and a 2021 survey by HSD sister publication The Medical Republic found about 50% of GPs thought PHNs weren’t doing a good job.

None of these stats are particularly flattering but given the ANAO report the question is whether it’s the PHNs and their management doing things badly, or is it that the people overseeing them – the DoHAC – isn’t managing them consistently for the sorts of outcomes everyone is looking for?

The RACGP’s submission to the ANAO review late last year pretty much said everything that the ANAO outlined this week:

“PHNs need to be held accountable through more consistent governance frameworks and external auditing rather than self-reporting. Performance management to date has been insufficient and must be made stronger and more transparent to provide assurance that funding allocated for primary care is being spent appropriately.”

A particularly pointed comment by the college was that PHNs seem to be hyper-fixated on service provision rather than ensuring outcomes.

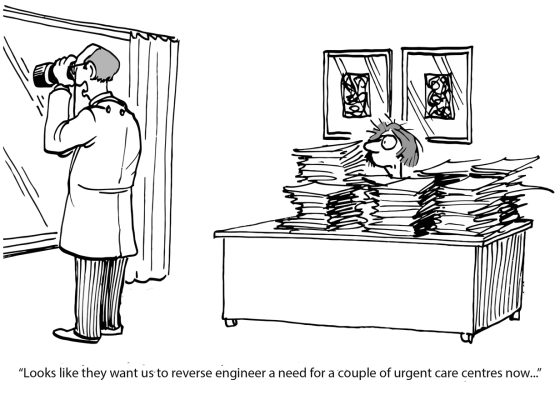

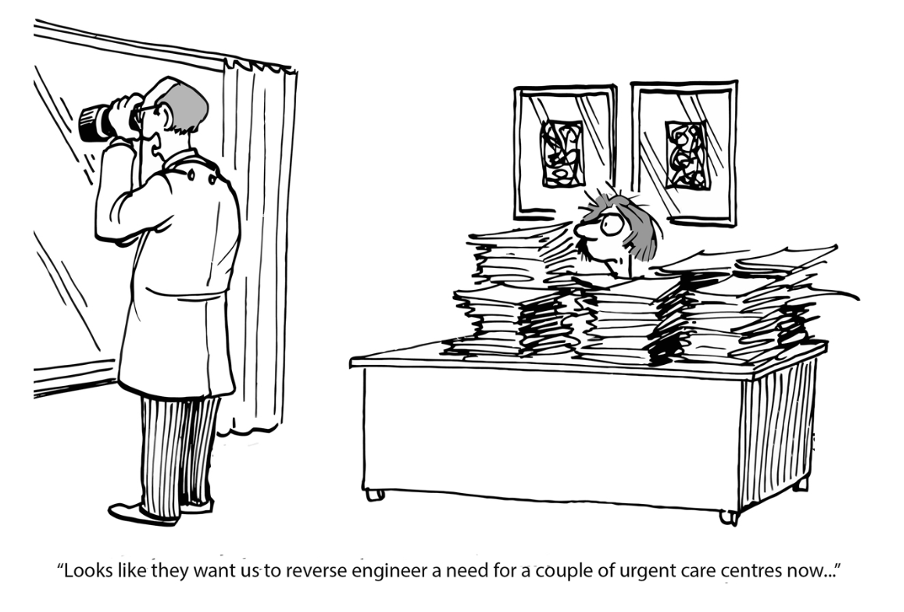

That comment resonated just a week ago in a piece we published by consultant Jay Rebbeck who works closely with PHNs and is a commissioning expert. He said that “PHNs are sometimes led into retrospectively identifying local needs to justify a predetermined Commonwealth decision to stand up a predefined service model.”

Translation (my translation not Mr Rebbeck’s): DoHAC comes up with what they think they want to do in a region, then they task a PHN to commission a needs analysis in the region with the intent of justifying what DoHAC thinks is needed.

This is obviously an upside-down process. Needs assessment should be first but in this dynamic, it’s getting reverse engineered. If this is happening on scale it might explain a lot of the problems that people are describing about PHNs and in particular their effectiveness in helping primary care.

We published the following cartoon to make the point and copped quite a bit of flak for it…it felt like we might have hit a particularly sore nerve on quite a specific topic.

When I attended my first PHN conference late last year I was a bit of a PHN cynic. When I left the conference I was confused. There wasn’t a person in the room over the two days who wasn’t energetic, smart and committed in some way to what they were trying to do.

I got the distinct sense that the problem might be in what they were being asked to do and how, which, from that conference, felt a bit all over the place, not the people and manner in which they were trying to deal with the tasks given them.

The ANAO report seems to back up such an assertion and underlines a possible reason why after many years of promising to measure PHNs and report on them properly and transparently (we first reported on the idea in 2018), it still hasn’t been done.

SROs scare tactics on payroll tax might backfire

The seemingly never-ending payroll tax carnival seemed to shift dynamic in the past two weeks with a couple of important developments which might indicate that within a year or so (sounds like a long time I know but in payroll tax time it’s light speed) GPs and owners are finally going to have a lot more certainty around what to do about the problem.

The most important development was an indication from the Primary Care Business Council that it was prepared to back some practices to take the Victorian State Revenue Office to court to defend what we assume are some audits in play where practices are being assessed as owing a lot.

It’s not entirely clear as to what is going on behind the scenes but if one or more corporates are now feeling that they have their ducks in a row enough to threaten the Victorian SRO with court action we might be nearing a major turning point in the whole payroll tax debacle.

If a corporate does back one or more of its practices to defend an audit one of three things can happen: they win, they lose, it’s settled.

If the corporates take a case to court and lose SROs will have another precedent to add to their so far pretty small pile of legal precedents, all of which are now mostly from a few years back when practices and owners were not nearly as wise to what you have to do to avoid being on the wrong side of an audit. That wouldn’t be good.

If a corporate went to court and won we would have our first precedent case which represents the opposite of what Thomas and Naaz started: a case in which practices and owners all over the country can look at the detail of how a practice “fought the law, and won”.

Such a precedent would obviously be great for GPs and owners, but pretty much the opposite for SROs all over the country, who until now have been using scare tactics to attempt to convince owners to convert to paying the tax at scale.

The scenario of going to court and winning is very unlikely to happen, not because a corporate wouldn’t win if they went to court but because if an SRO gets any whiff that they might lose they will settle and attempt to keep the settlement secret.

We know this because it’s happened a lot already.

We now know that a lot of practices have faced off SROs in a few states, with large amounts in play for owing payroll tax, and the SROs have backed off rather than go to court after practices fought them in preliminary proceedings.

If one or more corporates get this result, it will still probably represent a tipping point in the whole payroll tax affair.

Even without there being a legal precedent from a court case those corporates will understand what detail they need in their administrative set-ups to ward off the SROs and will make sure it is applied across all their sites.

After that it surely won’t be that long until word and knowledge spreads

In a funny way SRO rulings will not matter as much anymore because effectively unofficial rules will be in place through these below-the-waterline test cases (cases that never went to court).

One commentator said to me this week about the possibility of one of the corporates backing some of their practices all the way through to the court process: “Break out the popcorn if that actually happens…”

What he was inferring was that the big corporates wouldn’t spend the money nor take the risk if they didn’t now think they had a good chance of winning.

The broader implication, even of the corporates just making the threat, feels like the payroll tax situation is fundamentally starting to shift, rulings or not, and a lot more owners and practices and their accountants and lawyers are going to be a lot less confused moving forward in how to act.

That should mean that over time the whole thing settles down and ceases to be the existential threat to general practice that so many people have been suggesting.

The update to the Queensland SRO ruling this week in which it provided extensive detail and examples around payment flows felt a little like a last gasp at a tactic that some of the SROs and state governments have been trying.

In one way the QSRO ruling has been good because it’s been so comprehensive. But to go to such extraordinary detail to scare off practices using automated payment flow solutions with third party bank accounts – there might be a legal technicality here they are working with – feels like a lot of effort to close every opportunity a practice owner has to navigate their way out of the problem without going broke.

Software vendors and banks providing automated payment solutions are literally just trying to help by providing low-cost efficient solutions to the prior QRO ruling that they believe meets the criteria of payment flows going first from the patient to the doctor and then to the administrative entity (which weirdly in the QSRO examples the QSRO is calling a “medical centre” which they shouldn’t, as its confusing).

Queensland has for a while now had a bit of a facade of saying to GPs we are trying to help with this comprehensive ruling. But this addition looks a lot like them saying “just give up guys, there’s nothing you can do that is financially viable other than pay the tax”.

It’s the opposite of trying to help GPs no matter what fluff the political leaders of each state come out and say about being behind GPs and sorting this problem out.

The SROs have largely created confusion and fear, an environment in which scared owners will more easily take the bait of amnesty or a detailed ruling and restructure their set ups to start paying payroll tax.

Given the problems any entity would face if they did roll over from the ATO on the other side of the tax problem facing owners and GPs of tenant doctors being “deemed as employees”, it doesn’t look like many owners are falling for the scare campaigns anymore.

The state governments, whose politicians are constantly coming out and pumping their fists in support of the GP community, but whose SROs are at the same time prosecuting a very cynical and confusing campaign to press gang as many practices as they can into paying payroll tax, might have to wake up to the fact that if the corporates, who once were dead in the water on payroll tax, have worked out how to restructure and run their entities as proper administrative trusts rather than actual command and control medical centres, then most GP owners eventually will work it out as well.

And that maybe payroll tax in general practice isn’t the gold mine for state government revenues that obviously a lot of SROs have felt it might be.

Here’s hoping anyway.

Was the new RACGP CEO a “captain’s pick” and if so why?

I’ve waited a few weeks to ask this question in order to get some background on the new RACGP college CEO Georgina van de Water and on how she got chosen.

I couldn’t find anyone who would say a bad word about her. Not that I was looking for that, but I was trying to work out what sort of experience in business and leadership she had to make the inevitable comparison with Paul Wappett who got booted for reasons which still haven’t been made clear to anyone.

As a general reference from some quite influential and senior GP figures, none of whom are on the board or executive of the RACGP, and some of whom have been critical of college leadership in the past, Ms van de Water was described as a highly capable manager who was great with people, had really good negotiating skills and who was well liked broadly.

The RACGP board chair Dr Lara Roeske said Ms van de Water brought “extensive experience in senior leadership roles” to the job and had a track record of outstanding stakeholder engagement, which seems to align fairly closely with my unofficial reference check.

As pernickety as this may sound it’s informative to look at the CV and education of both Mr Wappett and Ms van de Water.

Ms van de Water’s CV basically reads from earliest to latest like this: Operations Manager Ashley and Martin (Hair Loss Clinic), COO Wentwest (Western Sydney PHN), various operational roles in Australia’s largest RTO Synergy until she was eventually CEO, Chief Training Officer at the RACGP (after the college took over Synergy in the early days of the training transition), and now CEO of the RACGP.

Her education is a Certificate IV from TAFE in “Frontline Management” and then a 12-month online MBA from the Adelaide-based Australian Institute of Business. Neither are particularly prestigious institutions for management training but of the most effective and relatable senior businesspeople I’ve ever worked with only one ever had prestigious qualifications (Harvard) and two had no qualifications past HSC level school.

Paul Wappett’s CV and education runs like this:

Solicitor, Clayton Utz (a top four law firm), Senior Legal Counsel, Mobil Oil, HR manager Fuels Division, Mobil Oil (well over a 1000 people in that group), Chief Commercial Officer Western Bulldogs (Iconic AFL club, was Fitzroy), Executive GM, CPAs (largest membership organisation in Australia by a long way with over 130,000 accountant members), CEO Open Universities Australia, CEO, Australian Insitute of Business, CEO RACGP.

And his education (he’s a bit of an overachiever): LLB, Law, UNSW, B Comm Accounting, Finance and Systems, UNSW, MBA Melbourne Business School (ranked by the AFR as Australia’s top MBA program, the AIB does not make it into the top 10.

Obviously, Ms van de Water has a major skillset in GP training, which is what is now more than half of the job of the college and that’s important. It’s also likely that Ms van de Water had a lot to do with the miraculous training transition the college pulled off.

But Mr Wappett’s experience and education are a long way in front, including the fact that he had worked extensively with both professional membership and training organisations of significant scale.

While Mr Wappett is a white male, what his background brought to the CEO job was the opportunity for quite a bit of diversity of thinking and of a lot of difference experiences to meet future college challenges.

What this possibly fascile comparison immediately suggests is it’s possible the board doesn’t like being challenged by new or outside ideas and that more likely they want someone they understand as a known quantity.

Known quantities can be a lot easier to control of course.

None of this is any reflection on Ms van de Water but it might be on the board and it might be worrying for some for some more discerning college members if they think this change through.

Mr Wappett was an outsider obviously with ideas and a passion to challenge the thinking of the board and the members. It looks like that is what may have brought him undone.

At the time that the board fired Mr Wappett they said they had started a global search for a new CEO. When you say that you usually employ a big expensive search firm and do what you say …” a global search”.

We asked the college to outline that global search process to us, to send us the key selection criteria they would be using in the search and interview process, how many candidates were identified and interviewed along with Ms van de Water and who interviewed the candidates.

We got this back:

Statement attributable to RACGP Board Chair Dr Lara Roeske

We ran a rigorous recruitment process that was in the public domain.

We have had a positive response about the appointment of Georgina van de Water as our new CEO from government, staff, and members.

In the lead up to International Women’s Day, we are celebrating having strong female leadership at the RACGP.

These were pretty innocent questions we thought, which you’d think the board would be prepared to be transparent on given what happened to the last CEO.

But from this trite answer we don’t even know if the RACGP interviewed anyone else in their “rigorous recruitment process that was in the public domain”.

By public domain I guess the college means they advertised the job.

But after that it’s anyone’s guess what actually happened.

Without a better answer as to what might have happened it would be easy to conclude that the board may well have just made a “captain’s pick” of an existing person they were very comfortable with. They could have even had this person in mind when they started becoming unhappy with Mr Wappett.

Was this appointment more or less a done deal all the way through the departure process of the last CEO?

If you think that’s just a conspiracy theory then go ask the board yourself why they won’t tell you if they even interviewed anyone else for the job.

Does it matter if they interviewed anyone else and didn’t really go through a “global search” because maybe the new CEO is going to be great?

Yes, it does matter.

One point that did come out after Mr Wappett’s departure was that some members of the board very clearly thought that he was far too much in the public and political eye and that he should be working “in the background” a lot more than he was.

In that narrative it has been suggested that the board felt that Mr Wappett might be even subsuming the role of the president by being too much involved in matters of political lobbying and deal making.

It’s for another time to discuss, but having presidents who are picked the way the college picks them and then having them for only two-year terms is a terrible model for getting stuff done properly in Canberra over the long term. The Pharmacy Guild should have taught the college that lesson a long time ago.

Without any transparency of what happened between Mr Wappett going and Ms van de Water arriving members are even more in the dark about what is going on than before.

Do we have a board that wants to run the RACGP, or a board that wants a CEO to run the RACGP according to the strategy that they oversee and develop?

If we do, the board is making a fundamental error in how boards are supposed to work in both public and private companies.

It’s corporate governance 101.

The main function of a board is to develop and oversee strategy with the executive team and employ a CEO and oversee the performance of that CEO and his or her management team in the execution of that strategy.

If the board wants a CEO they think they can relate to and control and which they don’t want to be seen or heard very much, what they really want is what is called an operations manager, and they want to act as the CEO.

That’s obviously a problem because the RACGP has no one on its board with decent leadership and management experience to perform such a role.

Mr Wappett made mistakes. His biggest one was not realising he was on the outer with certain individuals on the board and not managing his board.

Just doing a good job according to your riding instructions isn’t enough to keep your job as a CEO, even in a private or public company. You have to manage up and Wappett missed the dynamic that some board members were getting very worried that they didn’t have the control they obviously wanted. He didn’t manage expectations.

Ms van de Water looks clearly to be a safe and capable pair of hands.

And she might end up great. After all she came on board very early in the training transition process and it was likely her that did most of the work on what was in the end an incredible piece of business transformation in the college taking on training in such difficult circumstances in such a short space of time.

But why and how she was chosen points to some possible systemic long-term issues for the college and its members which are going to be very hard to break into now.

It’s virtually impossible to sack the board or the board chair or even challenge them from outside the board. These are problems in the college constitution which obviously the board isn’t going to fix.

Given that we have no idea now why Mr Wappett went and how Ms van de Water came, and the board isn’t prepared to ever tell this story, what agency do members think have in this set up?

What ability the members (stakeholders) have to influence the future of the college and how it rolls do they really have, given what we know from this episode of CEO turnover?