The CEOs of Ramsay and APHA say it didn’t and it would have been ‘howled down’ if it had. PHA is maintaining a dignified silence, citing confidentiality agreements even though it is not part of the forum. Yes, we’re confused too.

Confusion surrounds a proposal from Private Healthcare Australia that was sent to federal health minister Mark Butler on 6 March for presentation to the 7 March Private Health CEOs Forum, and copied to both the head of the private hospital viability review and the head of the private health strategy branch of DoHAC.

A spokesperson for PHA, which is not represented at the CEOs forum although CEOs of some of its member funds are, maintained that the proposal for a short-term financial assistance package for struggling private hospital operators was to be presented at the forum.

Yesterday, however, the CEO of Ramsay Health Care, Carmel Monaghan, seemed to suggest that had not happened, saying that “this was not discussed at the forum”.

“It would have been unequivocally howled down by the hospital CEOs present,” Ms Monaghan was quoted in the Australian Financial Review as saying.

“A once-off sugar hit is not what the sector needs. Private health insurers have the financial capacity to fully fund the recurring funding deficits private hospitals are experiencing on an ongoing basis, and Ramsay will be pushing for this. Our staff, our hospitals, and our patients deserve no less.”

Today the PHA maintained that the proposal was sent to Mr Butler prior to the meeting but that CEOs who attend the CEO Forum have signed confidentiality agreements about what is said during the meeting.

A spokesperson for Ramsay Health Care confirmed the quotes from Ms Monaghan in the AFR but said there was nothing further from the CEO or the company on the matter.

PHA’s proposal detailed a “hardship package” to be provided to hospitals that opened their books and could demonstrate a “genuine need for short-term funding assistance in areas where there are no other private hospital services nearby”. The assistance will be provided to ensure ongoing provision of services.

“This proposal will be implemented on the condition the federal government agrees to implement promised reforms to bring the cost of medical devices and surgical supplies in the private sector down to match the prices for public hospitals,” said the PHA proposal.

In a letter to Mr Butler on 6 March, PHA CEO Dr Rachel David said:

“Where there is currently a 7-20% surcharge on private patients for medical devices, a short-term approach could be for this surcharge to be provided to hospitals rather than device companies.

Related

“This would transfer around $84-120 million per annum to private hospitals, starting on 1 July 2025.”

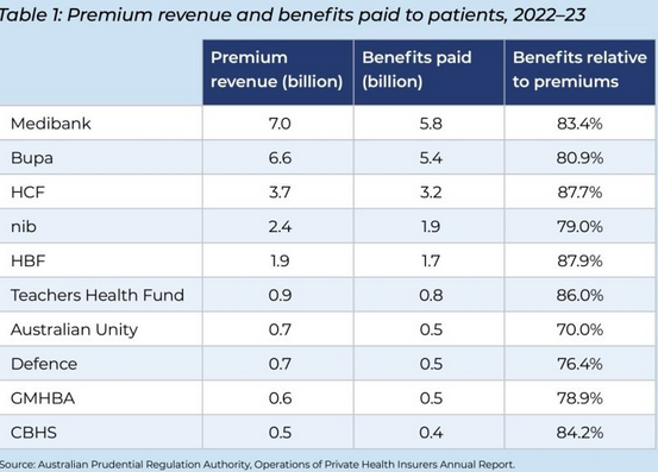

When once 88-90% used to be a benchmark proportion of rebates returned to hospitals, the latest APRA numbers suggest those percentages have dropped significantly.

Mr Butler, the AMA and the private hospitals operators want insurers to pay a higher percentage of their premiums to help fund hospitals.

However, the insurers rejected that idea, resulting in the PHA proposal sent to Mr Butler on Thursday.

This afternoon, the Australian Private Hospitals Association, Catholic Health Association and the Medical Technology Association of Australia put out a joint statement calling the PHA proposal “a nonsense plan”.

“Federal health minister Mark Butler’s public commitment to addressing the massive shortfall in funding by insurers, and ending their dominance in contracting over hospitals, is the core issue that is causing the viability crisis impacting hospitals, their services and, ultimately, patients,” said APHA CEO Brett Heffernan.

“Nothing less than insurance companies paying their way will do. The insurers are making record profits. They can afford to meet their responsibilities to fund the healthcare of their members in full without any increase in premiums.”

MTAA CEO, Ian Burgess, said:

“The large corporate insurers’ share prices are climbing because of their bumper profits. The minister for health has called out their price gouging, and now insurers want to gouge even more by further cutting benefits for life-saving medical devices.

“In contrast, despite MedTech only accounting for 8% of insurers’ revenue, our industry has more than done its part, enduring significant cuts and delivering savings totalling almost $290 million in the last two years alone—savings that insurers have simply pocketed. It’s well time health insurers paid their fair share.”

CHA’s director of health policy, Dr Katharine Bassett, said:

“The Prescribed List is not the place to look for more savings. We’ve already seen significant reductions in benefits paid for medical devices, yet those savings were not passed on to patients. Instead, insurers pocketed the difference.

“It’s clear insurers are prioritising their profits over patients. The way we fund care in the private sector needs to be reformed so private health insurers can’t continue to siphon money away from hospitals and patient care.”